© Southeast Appraisal Resource Associates, Inc. 2019

INSURANCE APPRAISAL INFORMATION

Southeast Appraisal

Southeast Appraisal

3350 Riverwood Parkway

Suite 1900-19077

Atlanta, Georgia 30339

Phone: (770) 883-6987

Fax: (866) 839-7887

As management, one may be concerned about the amount of insurance that is carried on your plant

or commercial facilities. Or, your insurance carrier or insurance broker may suggest or demand that

an appraisal be purchased.

Some insurance companies still provide this service, but generally such is not the case.

So the question arises, who offers the necessary service, what is there to purchase and what are the

differences in what is offered. The uninformed services purchaser is at a disadvantage. The purpose of

this brief paper is to offer assistance to the buyer concerning the levels of service being offered or

considered, and the service needs fulfilled by the varying service levels.

Being very direct, an insurance appraisal fulfills three service needs (nothing more), these are:

1.

Independence,

2.

Value information, and

3.

Preparedness for a loss situation.

Further, these service levels fulfill the above service needs to differing degrees. To simplify the

information a bit, let’s assume that any service being offered is independent in nature, not being

offered by an insurance carrier, broker, or a conflicting interest provider.

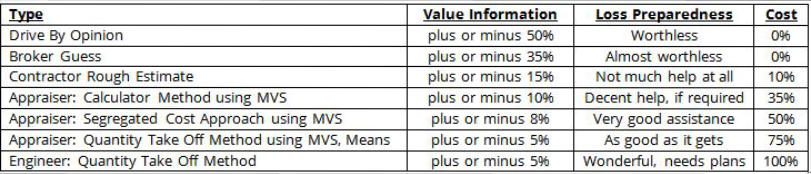

SERVICE LEVEL EXAMPLES FOR BUILDING STRUCTURES

Comment: Generally, the best balance of accuracy and loss preparedness is fulfilled by selecting either

the professional appraiser’s Calculator Method or the professional appraiser’s Segregated Cost

Approach. The primary construction cost services used by appraisers are Means, Boekch, and

Marshall Valuation, with all three being generally adequate but each having particular advantages /

disadvantages in use.

And please get a set of plans out of the building, and take overlapping photos of the interior and

exterior, or make a video, and get this also out of the building. Therefore if there is a loss one has

certain elements of information necessary to prove to the adjuster / value expert what there was.

SERVICE LEVEL EXAMPLES FOR CONTENTS (FURNITURE AND FIXTURES, MACHINERY AND

EQUIPMENT)

Comment: Generally, the best balance of accuracy and loss preparedness is fulfilled by selecting either

the experienced appraisers walk through or the fair / excellent detailed levels of service. For the

difference of 15% the excellent detailed level of service is prudent, unless the company has other

proof of loss information that is, very good fixed asset records, engineering detail, etc. (off-site copies

please to protect the data).

And please have overlapping photos of the contents, and particularly photos of each major asset.

A personal note, do this for your residence as well.

Southeast Appraisal

3350 Riverwood Parkway

Suite 1900-19077

Atlanta, Georgia 30339

Office: (770) 859-0338

Cell: (770) 883-6987

Fax: (866) 839-7887

© Southeast Appraisal Resource Associates, Inc. 2015

INSURANCE APPRAISAL

INFORMATION

Southeast Appraisal

As management, one may be concerned about the amount of

insurance that is carried on your plant or commercial facilities.

Or, your insurance carrier or insurance broker may suggest or

demand that an appraisal be purchased.

Some insurance companies still provide this service, but

generally such is not the case.

So the question arises, who offers the necessary service, what

is there to purchase and what are the differences in what is

offered. The uninformed services purchaser is at a

disadvantage. The purpose of this brief paper is to offer

assistance to the buyer concerning the levels of service being

offered or considered, and the service needs fulfilled by the

varying service levels.

Being very direct, an insurance appraisal fulfills three service

needs (nothing more), these are:

1.

Independence,

2.

Value information, and

3.

Preparedness for a loss situation.

Further, these service levels fulfill the above service needs to

differing degrees. To simplify the information a bit, let’s

assume that any service being offered is independent in

nature, not being offered by an insurance carrier, broker, or a

conflicting interest provider.

SERVICE LEVEL EXAMPLES FOR BUILDING STRUCTURES

Comment: Generally, the best balance of accuracy and loss

preparedness is fulfilled by selecting either the professional

appraiser’s Calculator Method or the professional appraiser’s

Segregated Cost Approach. The primary construction cost

services used by appraisers are Means, Boekch, and Marshall

Valuation, with all three being generally adequate but each

having particular advantages / disadvantages in use.

And please get a set of plans out of the building, and take

overlapping photos of the interior and exterior, or make a

video, and get this also out of the building. Therefore if there

is a loss one has certain elements of information necessary to

prove to the adjuster / value expert what there was.

SERVICE LEVEL EXAMPLES FOR CONTENTS (FURNITURE AND

FIXTURES, MACHINERY AND EQUIPMENT)

Comment: Generally, the best balance of accuracy and loss

preparedness is fulfilled by selecting either the experienced

appraisers walk through or the fair / excellent detailed levels

of service. For the difference of 15% the excellent detailed

level of service is prudent, unless the company has other

proof of loss information that is, very good fixed asset records,

engineering detail, etc. (off-site copies please to protect the

data).

And please have overlapping photos of the contents, and

particularly photos of each major asset.

A personal note, do this for your residence as well.