© Southeast Appraisal Resource Associates, Inc. 2019

FINANCIAL BENEFITS OF A WISE APPRAISAL

Southeast Appraisal

Southeast Appraisal

3350 Riverwood Parkway

Suite 1900-19077

Atlanta, Georgia 30339

Phone: (770) 883-6987

Fax: (866) 839-7887

Below is some information relating primarily to tangible asset appraisal and valuation matters that may

be useful. In this material is actionable value related strategies and techniques that may well save or

gain quite material cash flow benefits.

In preparing this information a number of points were considered as follows:

1.

Generally accounting and finance folks have an overview idea of appraisals but are not aware of

the intricacies of such strategies / procedures / reports for varied applications.

2.

Conversely, many appraisers are not aware of the procedures and requirements of fixed asset

accounting for financial and/or tax reporting, managerial accounting, or finance.

3.

The above two points reflect the generalized lack of knowledge and understanding across these

two professions that is unfortunate, particularly for the users of the services since direct and/or

opportunity costs are therefore incurred.

4.

To complicate the matter further public vs. private companies may have differing objectives

depending on their respective cash flow vs. reported earnings objectives.

The requirement to engage an appraiser may be a bother, particularly when it involves an expense

without a direct return. Perhaps an insurance valuation is the best example of costs without return.

Until a loss occurs all is very “pleasant”, but then a loss occurs and one must deal with the claim

adjuster of the insurance company. The second costly event not offering a direct benefit may be an

appraisal of tangible and/or intangible assets for financing purposes. Additionally, we have fair value

accounting, which does not generate a direct return but certainly effects earnings through depreciation

and/or amortization charges.

Yet in many other appraisal / valuation instances, a significant return on dollars expended may be

realized. A financial advantage may be realized by knowing more about a specific matter, or being

smarter about the matter. Examples of such situations are property tax reporting, accelerated

depreciation studies, federal income tax reporting, fixed asset accounting and information system

techniques, and so forth. If one puts together the financial advantages / returns of each valuation

process, with benefits of other processes, the return on investment results may be compounded.

In this article there are specifics relating to the following:

•

Fixed Asset Accounting

•

Accelerated Depreciation, aka Cost Segregation Analysis

•

Federal (IRS) or State (DOR) Income Tax Reporting

•

Fair Value Accounting

•

Property Tax Appraisals / Appeals

•

Tagging of Assets

•

Insurance Valuations and Loss Preparedness

Fixed Asset Accounting

The wise knowledge and use of fixed asset accounting procedures and systems, with astute appraisal /

valuation strategies, is the linkage to realizing direct and opportunity financial benefits.

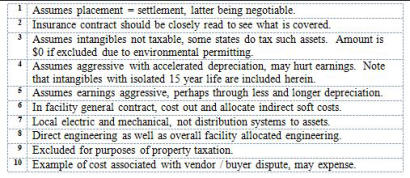

The below spreadsheet is a simplified example of how the elements of an asset booking may vary

depending upon the reporting application. Be aware it is inappropriate to report a different component

of value for different applications. However, it is acceptable to consider in the overall value differing

specific components. In the spreadsheet below the most obvious example is not to report or exclude

the environmental permitting for property tax purposes. Another obvious example is not to include a

legal dispute in the insurance reporting cost. The spreadsheet is not meant to represent the exact way

to book assets for differing applications. Rather it is presented to give the reader the idea of what can

possibly be done. Firms should have an overall detailed procedural manual in this regard, as well as

certainly have the fixed asset accounting software that can handle the varied entry and informational

requirements for each reporting application. Unfortunately many fixed asset reporting software

systems are weak in their capability to isolate differing booking cost elements. This costs the user many

dollars. Further, the fixed asset accounting staffs of many firms often are not aware / trained in the

financial benefits of differing appraisal / valuation and fixed asset reporting strategies.

Perhaps the accountants handling the fixed asset accounting policies / procedures are doing an

acceptable job from their compliance and auditing perspective. However, a view and discussion of the

processes from the perspective of appraisers / valuers also knowledgeable of accounting may enhance

the processes. The idea is to get the practitioners in these two professions working together to look for

beneficial financial opportunities. It may be as simple as assigning values to coded fields and/or setting

up multiple books for differing applications.

General Note: In appraisal language historical cost is the cost to the first user / owner. Original cost is

the cost to each of the subsequent users / owners. In a purchase price allocation the entries therefore

would be original cost, and there may be a “step up” in value to what for financial reporting is called Fair

Value, or for federal income tax purposes is called Market Value (appraisers consider these value

concepts to be synonymous to Fair Market Value in Continued Use with an Earnings Analysis or with

Assumed Earnings).

A poor fixed asset record lists the assets as just below with the cost shown:

Dust Collector

$20,000

Boom Lift

$15,000

Mixer

$40,000

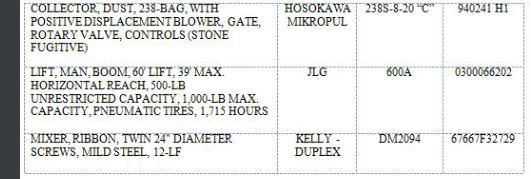

A good fixed asset system description of the assets, also including location, tag number, flow diagram

number, locational data, date of acquisition and cost information is as follows:

Accelerated Depreciation, aka Cost Segregation Analysis

Accelerated depreciation allows companies to deduct the costs of assets faster than their value actually

declines. The thought “faster than their value actually declines” is debatable. Regardless of this possible

debate, accelerated depreciation does allow faster depreciation than straight line, and perhaps over a

shorter life. Further, depreciation for federal income tax purposes usually will be faster than the

“matching principle” of usual accounting practices.

But rather than just an isolated machine or a computer, there are cost components of new and/or

previously owned facilities that may be eligible for accelerated depreciation. This important subset of

the concept of accelerated depreciation by appraisers and income tax practitioners is referred to as

Cost Segregation Analysis.

Under United States tax laws and accounting rules, cost segregation is the process of identifying

personal property assets that are grouped with real property assets, and separating out personal

property assets for tax reporting purposes. A cost segregation study identifies and reclassifies personal

property assets to shorten the depreciation time for taxation purposes, which reduces current income

tax obligations. Personal property assets include a building’s non-structural elements, exterior land

improvements and allocated indirect construction costs.

The primary goal of a cost segregation study is to identify all construction-related costs that can be

depreciated over a shorter tax life (typically 3, 5, 7 and 15 years) rather than the building (39 years for

non-residential real property). Think cash flow here based upon more depreciation for federal income

tax purposes. Yet the eligible assets (debatably) may be classified differently for financial reporting

purposes, thereby realizing the financial benefits of both strategies. If so, the fixed asset accounting

system must be capable and structured to accommodate these procedures.

Personal property assets found in a cost segregation study generally include items that are affixed to

the building but do not relate to the overall operation and maintenance of the building. Land / Site

Improvements generally include items located outside a building that are affixed to the land and are not

inherent to the overall operation and maintenance of a building. Reducing tax lives results in

accelerated depreciation deductions, a reduced tax liability, and increased cash flow.

For an office building cost examples of non-structural elements eligible for accelerated depreciation are

“strippable / reusable” wall covering, tacked down carpeting, millwork, accent lighting, allocated portions

of the electrical system, and so forth. Relating to site improvements eligible property is site

improvements such as sidewalks and landscaping, etc. Again, such eligible assets may be depreciated

over 3, 5, 7 or 15 years, rather than over 39 years.

For a manufacturing or processing facility the components of the facility that generally relate to the

production processes are eligible. Examples would be special exhaust systems and drainage systems,

equipment foundations, machinery enclosures and platforms, allocated utilities, and so forth. A very

large enclosed equipment platform is not a 39 year lived building.

Whether the facility is new or previously owned does not matter. The “engineering” analyses of the costs

eligible for accelerated depreciation are similar. Further, it is not just the direct costs that are eligible but

also an allocation of the indirect costs to each asset is includable in the calculation. This latter

consideration in the cost segregation analysis of new facilities is often captured by service provider

professionals. For previously owned structures elements of indirect costs sometimes may be

overlooked, unless an experience appraiser knowledgeable in cost segregation techniques handles the

allocation matter. Accountants usually cannot do this well.

Federal (IRS) / State (DOR) Income Tax Reporting

Financially it seems prudent to appropriately and legally pay the least amount in taxes. Therefore, when

completing an valuation there is an innate orientation to optimize fixed asset accounting booking

strategies considering asset classification and value element inclusion / treatment. Private entity clients

appreciate this orientation, particularly when they understand that the appraisal / valuation fee may be

greatly exceeded by the present value of the cash flow enhancements through accelerated depreciation

/ amortization. Some, however, due to their particular tax / earnings orientation may not be able to

enjoy such financial benefits and unfortunately extend the depreciation / amortization (the IRS / DOR is

more pleased with this). The public clients, who have an orientation towards earnings enhancement,

may be willing to pay an increased income tax payment price by extending depreciation / amortization

(again, the IRS / DOR is pleased). There may be a conflict of objectives between not only the private vs.

the public taxpayer, but also the profitable taxpayer vs. the less / not profitable taxpayer.

So what to do? Discuss with the CEO / CFO or the other appropriate party(s) the issues addressed, and

others, within this document. Communication and understanding is critical. Be direct. Ask the simple

question “are you tax or earnings oriented”. Likely the private client will say “tax”. Then go deeper by

asking “can you stand as much accelerated depreciation / amortization as may be appropriately

developed”. A caution, the maximum tax benefits may affect loan covenants that are in place. Based

upon the answers to these questions discuss the available appraisal / valuation and fixed asset

accounting techniques that may be considered / utilized.

The same questions should be asked of the public client, whereas the private client may lean either way,

more likely the public client may lean towards earnings enhancement (but not always). The public client

may want to “balance” taxation matters with the earnings objectives of the business operation. This may

well be a sensitive issue to discuss. Note that the value information may not change but the

classification of the valuation data may be coded to fit the situation / objectives.

Fair Value Accounting

Books and official guidelines have been written on this subject. Some salient thoughts are offered

herein for consideration.

A key thought is that U.S. Fair Value Accounting is slightly different from International Fair Value

Accounting, particularly as it relates to including varying levels of synergy and transaction costs. The

guidelines have changed over time and continue to be in exposure draft form and/or under review. A

review of the most current drafts and guidelines is always appropriate.

The appraiser is assisting the reporting entity in developing the Fair Value Accounting document /

report. That is, the Chief Financial Officer is the ultimate signer and provider of the document, assisted

by the appraiser / valuer. The CFO is in charge.

The wise appraiser / valuer will have thorough discussions with the CFO or the appropriate party

concerning the quality of the selling entities fixed asset accounting record. They will also discuss tax or

financial reporting drivers, as well as the cost / benefits of valuation needs that may be cost effectively

fulfilled during a fair value accounting study (i.e. a new fixed asset accounting record, insurance

placement values, insurance proof of loss preparedness, accelerated depreciation, property tax

minimization).

So how is such a “fair value accounting” study completed?

Tangible Assets (Real Property and Tangible Personal Property, aka Machinery and Equipment)

As noted above, discussions are held with the CFO, and perhaps the external auditor.

The quality of the existing fixed asset record is reviewed. Generally such records are poor to fair. The

choice has to be made whether to use (migrate) religiously the prior record, use some information to

degrees, or discard the old record and create a new record. As an aside, there is not a direct cost to

discarding the old record, in any regard. Yet, the old record likely will need to be retained and

maintained for property tax reporting (rendition) requirements.

The fair value accounting report service options to varying degrees may be:

•

The appraiser using the old record models (”trends and bends”) the values into Fair Value, or

•

The appraiser using the old record models the values into Fair Value, tests the accuracy of

information provided, and goes to the marketplace for value information, or

•

The appraiser develops a new detailed inventory of the assets, and goes to the marketplace for

value information.

In either of the three above generalized procedures, usually a digital file (EXCEL) is given to the CFO to

facilitate uploading the data into the company’s fixed asset accounting system.

Intangible Assets, Business Enterprise Value, Economic Support, Bargain Purchase

Again, books have been written on this subject. Intangible assets are valued essentially using

discounted cash flow techniques and/or market comparisons, if available.

The business enterprise should be valued to ascertain the overall value and to see if there is a bargain

purchase. The concept of a bargain purchase most directly may be developed through this procedure

(other written procedures are fundamentally flawed). If the business value (being invested capital

defined as the sum of the non-current liabilities with the valued equity) is materially equal to the

effective purchase price there is not a bargain purchase.

If there is not a bargain purchase yet the initially appraised value of the tangible assets is greater than

the indicated level of economic support (the purchase price), then the tangible assets are reduced for

this relative difference, called economic obsolescence. Note that the tangible asset appraisal should

consider physical deterioration, functional / technological obsolescence, and utilization. Lastly,

accounting protocol indicates that the impairment of the assets for economic obsolescence may not go

beyond net orderly liquidation value.

Some interesting issues / thoughts:

•

An example of economic support / obsolescence is a company that makes VHS tapes / cartridges.

The level of economic support is inadequate due to external obsolescence.

•

Can the same asset have differing Fair Market Value in Continued Use values within the same

plant? Yes, depending upon the asset utilization and product made. For example, a plant that

makes left hand and right hand golf clubs with the left hand specific assets on a production line

having less value. Why, because there are fewer left handed golfers and therefore less demand.

•

Can the same asset have differing Fair Market Value in Continued Use values within differing

plants? Yes, as just above noted, depending on the capital contribution level.

How May Others Complete a Fair Value Accounting Valuation?

It depends upon who is completing the requisite tangible and intangible assets valuation. A general

thought is that if one single entity is not controlling / coordinating the analysis and/or aware of the

nuances of the valuation techniques relating to business valuation, intangible assets valuation, real

property appraisals, tangible personal property appraisals, and of course applicable valuation

guidelines – watch out! Conversely if a given entity is completing only one discipline element (say the

real property analysis) of the valuation they should understand how their work properly inter-relates

with elements of the analysis completed by the other discipline (as intangibles and machinery).

Unfortunately too often a specific discipline service provider either does not understand the valuation

concepts of the other disciplines, does not want to know, or is not given the opportunity to intelligently

and thoroughly discuss the matter.

Some service providers emphasize ‘trending and bending” aka “modeling”. This means the practitioner

takes the current fixed asset record and “indexes” the values upward for inflation considerations and

depreciates the assets down for age / life considerations. The prior sentence is “appraisal speak”. In

English, based upon varying levels of expertise and the quality / usability of the fixed asset record the

resulting Fair Value information is properly developed.

The issues the practitioner at least may consider are as follows:

•

prior allocations on the record;

•

current and changing capitalization policy;

•

what value elements are included in the cost data;

•

how are repairs, trade-ins, asset movement, etc. treated;

•

has a full physical or testing physical inventory of assets been completed;

•

what assets are on the record but not in place or partially in use;

•

is there functional obsolescence;

•

is there technological obsolescence;

•

are certain assets not being fully used;

•

is there economic obsolescence and how is it being developed; and

•

how to properly handle Construction in Process / Progress (”CIP”).

The Fair Value accounting practitioner should address at least all these issues.

Property Tax Appraisals / Appeals

In order to properly address property tax (Ad Valorem Taxation) a separation of real property vs.

tangible personal property is appropriate.

Real Property

In general, the local assessor essentially values the buildings and site improvements using the Cost

Approach methodologies. The land is typically valued using the Sales (Market) Comparison Approach.

The improvements are usually trended up for inflation each year until perhaps a mass revaluation is

completed or the assessment is appealed.

It is wise to separate out of the real property assets that can be identified as tangible personal property,

which instead of forever increasing in value actually decrease in value, or may be exempt from taxation

due to environmental use (as effluent collection ponds / dams). More later on this issue in Tangible

Personal Property below.

Tangible Personal Property (machinery / equipment)

In the U.S. tangible personal property (aka personalty) may be considered as anything other than the

basic building structure and land improvements. Yet certain assets like silos or large holding tanks may

be considered by the tax assessor as real property. Why? Personal property may not be taxed in the

local jurisdiction and/or if the asset is called real property the taxable value increases forever. Such is

the tax assessor’s perspective and strategy.

Other than the above thought personalty when booked new (the historical cost) is the basis of value.

With the renditions submitted (requisite periodic tax reporting information) by the taxpayer this basic

data is “indexed” up for inflation, and then “depreciated” for property tax assessment calculations down

to likely a 10% or 20% minimum. The struggle with the tax assessor is that the indexing does not

consider technology advancements or outside market forces. Further, the depreciation factors are

arbitrary and do not reflect market considerations. These two basic problems with indexing and

depreciation application skew the values most often higher than the assessment definition of Fair

Market Value. Such is the constant property tax value struggle.

All too often the fixed asset record of the taxpayer overstates the historic information provided. Here

are some points / strategies to receive a fair assessment for property taxation.

1.

Book the assets properly in the first place. Do not include any direct or indirect intangible assets

such as engineering, permitting, legal fees, in house oversight, etc. The value should only be the

f.o.b. cost of the asset, freight, perhaps sales taxes, rigging, millwright, local utility hookup, etc. The

intangible assets relating to the asset may be entered into a separate linked field in the fixed asset

record. Note that in some states engineering is included as being taxable.

2.

Properly identify assets that may be listed as tangible personal property (such as equipment

enclosures, platforms, or silos) by the taxpayer but that the assessor may include in their real

property value assessment. If not done these asset entries and their values could result in their

being doubly taxed, i.e. as both real property and tangible personal property.

3.

Properly identify assets that are excluded from taxation for environmental reasons. Assure that

you have the proper paperwork (permitting) authorizing such treatment of these assets.

4.

Describe the assets properly looking forward to how to identify such assets say 5-20 years hence

when they are disposed. This is critical.

5.

Annually have the appropriate personnel at each facility peruse the fixed asset record for assets

that have been disposed, scraped, not in service, partially used, etc. Again, the assets need to be

properly described in the first place. Assets on the fixed asset record that are not in place and in

use are referred to as “ghost assets”.

6.

Do not render (report for property taxation) non-value adding assets such as short term repairs /

maintenance, moving an asset from one place to another, demolition, training, etc. Such assets

perhaps should be expensed, or if booked for reasons of accounting amortization / depreciation,

can be coded for such thoughtful treatment.

7.

Upgrades to assets may be rendered (debatable). However, possibly only a portion of the cost

should be considered as actually adding value.

8.

One way to calculate the historic cost of disposed assets scheduled but not identifiable on a

“weak” fixed asset record is to apply reverse inflationary factors to the current costs of such assets.

An estimate but better than doing nothing and being taxed forever on assets that are gone (ghost

assets).

9.

Asset transfers are often at net book value. It perhaps would be wiser to transfer at used market

value adding depreciated reinstallation costs. The transferor may take a loss, but the transferee

books the asset “properly”.

10.

Costs related to the disposal of an asset should be expensed. Yet many times when an asset is

replaced not only is the disposal of the initial asset not properly handled, but the disposal cost of

the asset is rolled into the costs of installing the replacement asset. This is not good.

11.

Determine if taxes are included in the historic cost rendered. If so this may be considered taxation

on a tax.

12.

When booking an asset the thought “what value is added” should be the basic principle. Note that

the phrase is “what value” not “what costs”.

13.

Along this line as 12 above, rework, repairs, other excessive costs are not “value added”.

14.

Make assumptions, as possible and appropriate, that if an asset is beyond its normal useful life

then the asset has been disposed. Obvious example is a 10 year old computer on the fixed asset

record. When in doubt consider the asset disposed.

Assuming that the fixed asset record is appropriately “cleaned” of entries that could not be reported or

have been reported in error there is still more to do. It may be appropriate and reasonable to consider

additional depreciation factors, such as functional obsolescence, technological obsolescence, and

economic / external obsolescence.

Remember, the tax assessor would like all the assets to be categorized as forever increasing real

property vs. decreasing in value (to 10% or 20% of historic cost) tangible personal property.

In summary, addressing property taxation overpayments may well be a significant cash flow enhancer.

When blended with a Fair Value appraisal, an insurance appraisal, or even a financing / refinancing

appraisal, there may be significant fee savings.

Insurance Valuations and Loss Preparedness

An insurance appraisal fulfills three needs: these are independence, placement value data, and proof of

loss preparedness. Differing levels and types of insurance appraisals fulfill each of these needs to

differing degrees. Addressing each need in turn below:

Independence: the insurance company would like to see an appraisal from an outside firm. This is

somewhat obvious so that there is not fraud perpetrated by the assured. Some insurance companies

have their own appraisers but unpleasant loss settlement situations may still occur.

Placement: an independent valuation will inform the assured about the amount of insurance to carry.

Such an analysis may be completed in great detail with say a +/-10% possible variance or in an overview

manner with a +/-20% or greater variance. Be wary, just because the insurance carrier does an

insurance placement value analysis, as stated before an unpleasant loss situation may occur, with the

insurance company denying that the proper amount of insurance was carried.

Proof of Loss: along with having the appropriate amount of insurance, this is the most important

element of an insurance appraisal. Directly stated, if one is not prepared to prove one’s loss instantly

10% of a fair settlement is gone. If not well prepared this loss settlement amount may be 25% or even

more. The strategy is to get a balanced fair and equitable settlement in a timely manner. These

thoughts are directly linked. One can get a fair settlement say 5 years hence, but it is not timely. Or one

can get a timely less fair settlement if one accepts 75 cents on the dollar. Again, not good. One wants

the fair settlement at full value in say 6-12 months or whatever time is appropriate for the loss situation,

balancing the wishes of “fair” and “timely” is the critcal concept.

What is adequate Proof of Loss?

The fixed asset accounting record most often is greatly inadequate for a loss situation. Without going

into a long explanation, many fixed asset accounting systems contain data that includes intangibles in

the values, non-value entries, allocated values from acquisitions, “ghost” assets, and on and on.

The appropriate proof of loss document may be an independently developed appraisal and listing of

assets, with this document being annually updated by facility staff or outside consultants. Flow

diagrams help. Photographs and movies of specific assets and systems help. Files that have original

purchase costs and descriptive detail are wonderful (but rarely are available). Engineering records may

help. However, for most facilities / operations the assured is not prepared. Oversight in this regard is

strongly suggested. Why, because ultimately it is the assured’s responsibility to reasonably prove one’s

loss.

For those facilities where a detailed valuation for Fair Value accounting is prepared the information is

very good, at that instant. Yet the information must be kept up to date. It must be kept up to date

either within the fixed asset accounting system or as a separate aside record.

Critical property and casualty insurance thoughts:

•

One may rather deal with the IRS than fight an insurance battle.

•

Understand the insurance policy (contract) coinsurance clause wherein the assured shares in the

settlement to the extent of the insurance that should have been carried, say 80%.

•

The fixed asset accounting record is not adequate proof of loss.

•

Understand the difference between a Replacement Price policy and an Actual Cash Value policy.

•

Replacement Price policies are “repair or replace” often up to Actual Cash Value (a litigious issue

considering the issues of Market Value, depreciation or betterment). Usually the insurance policy

states that Acutal Cash Value will be paid until or if the covered assets are replaced (the language

varies per differing insurance contract forms). If under a Replacement Price policy the carrier

depreciaes labor, the carrier could be acting in “bad faith”.

•

Actual Cash Value policies generally consider the current cost new for the same functional utility of

the covered assets less physical depreciation / deterioration. However, in some instances, Actual

Cash Value is considered to mean the cost of replacing the asset at Fair Market Value - Removed,

or Used Market (another litigious issue).

•

Being unprepared to prove one’s loss may be extremely costly.

•

The insurance company will not pay for betterments, meaning if you have an old Model A asset

and now a Model B is only available you will not receive the settlement for a Model B loss. Check

insurance contracts in this regard concerning betterments.

•

The insurance company may well not pay for engineering or intangible assets relating to specific

tangible assets. Check the policy and/or discuss this matter with the broker.

•

Understand what the insurance policy says. One can underinsure as well as over insure.

A personal note. Are you prepared for a loss at your home? Do you have the proof of value and listing of

the assets, or at least photos or a movie of the residence and the contents? Is this information

somewhere else other than in your residence? All are encouraged to get prepared for an unfortunate

insured event. But imagine in a loss situation how much less of a fair settlement you would receive if

such data is not available. Then project this thought into your business situation.

Southeast Appraisal

3350 Riverwood Parkway

Suite 1900-19077

Atlanta, Georgia 30339

Office: (770) 859-0338

Cell: (770) 883-6987

Fax: (866) 839-7887

© Southeast Appraisal Resource Associates, Inc. 2015

FINANCIAL BENEFITS OF A WISE

APPRAISAL

Southeast Appraisal

Below is some information relating primarily to tangible asset

appraisal and valuation matters that may be useful. In this

material is actionable value related strategies and techniques

that may well save or gain quite material cash flow benefits.

In preparing this information a number of points were

considered as follows:

1.

Generally accounting and finance folks have an overview

idea of appraisals but are not aware of the intricacies of

such strategies / procedures / reports for varied

applications.

2.

Conversely, many appraisers are not aware of the

procedures and requirements of fixed asset accounting

for financial and/or tax reporting, managerial accounting,

or finance.

3.

The above two points reflect the generalized lack of

knowledge and understanding across these two

professions that is unfortunate, particularly for the users

of the services since direct and/or opportunity costs are

therefore incurred.

4.

To complicate the matter further public vs. private

companies may have differing objectives depending on

their respective cash flow vs. reported earnings

objectives.

The requirement to engage an appraiser may be a bother,

particularly when it involves an expense without a direct

return. Perhaps an insurance valuation is the best example of

costs without return. Until a loss occurs all is very “pleasant”,

but then a loss occurs and one must deal with the claim

adjuster of the insurance company. The second costly event

not offering a direct benefit may be an appraisal of tangible

and/or intangible assets for financing purposes. Additionally,

we have fair value accounting, which does not generate a

direct return but certainly effects earnings through

depreciation and/or amortization charges.

Yet in many other appraisal / valuation instances, a significant

return on dollars expended may be realized. A financial

advantage may be realized by knowing more about a specific

matter, or being smarter about the matter. Examples of such

situations are property tax reporting, accelerated depreciation

studies, federal income tax reporting, fixed asset accounting

and information system techniques, and so forth. If one puts

together the financial advantages / returns of each valuation

process, with benefits of other processes, the return on

investment results may be compounded.

In this article there are specifics relating to the following:

•

Fixed Asset Accounting

•

Accelerated Depreciation, aka Cost Segregation Analysis

•

Federal (IRS) or State (DOR) Income Tax Reporting

•

Fair Value Accounting

•

Property Tax Appraisals / Appeals

•

Tagging of Assets

•

Insurance Valuations and Loss Preparedness

Fixed Asset Accounting

The wise knowledge and use of fixed asset accounting

procedures and systems, with astute appraisal / valuation

strategies, is the linkage to realizing direct and opportunity

financial benefits.

The below spreadsheet is a simplified example of how the

elements of an asset booking may vary depending upon the

reporting application. Be aware it is inappropriate to report a

different component of value for different applications.

However, it is acceptable to consider in the overall value

differing specific components. In the spreadsheet below the

most obvious example is not to report or exclude the

environmental permitting for property tax purposes. Another

obvious example is not to include a legal dispute in the

insurance reporting cost. The spreadsheet is not meant to

represent the exact way to book assets for differing

applications. Rather it is presented to give the reader the idea

of what can possibly be done. Firms should have an overall

detailed procedural manual in this regard, as well as certainly

have the fixed asset accounting software that can handle the

varied entry and informational requirements for each

reporting application. Unfortunately many fixed asset

reporting software systems are weak in their capability to

isolate differing booking cost elements. This costs the user

many dollars. Further, the fixed asset accounting staffs of

many firms often are not aware / trained in the financial

benefits of differing appraisal / valuation and fixed asset

reporting strategies.

Perhaps the accountants handling the fixed asset accounting

policies / procedures are doing an acceptable job from their

compliance and auditing perspective. However, a view and

discussion of the processes from the perspective of appraisers

/ valuers also knowledgeable of accounting may enhance the

processes. The idea is to get the practitioners in these two

professions working together to look for beneficial financial

opportunities. It may be as simple as assigning values to coded

fields and/or setting up multiple books for differing

applications.

General Note: In appraisal language historical cost is the cost

to the first user / owner. Original cost is the cost to each of the

subsequent users / owners. In a purchase price allocation the

entries therefore would be original cost, and there may be a

“step up” in value to what for financial reporting is called Fair

Value, or for federal income tax purposes is called Market

Value (appraisers consider these value concepts to be

synonymous to Fair Market Value in Continued Use with an

Earnings Analysis or with Assumed Earnings).

A poor fixed asset record lists the assets as just below with the

cost shown:

Dust Collector

$20,000

Boom Lift

$15,000

Mixer

$40,000

A good fixed asset system description of the assets, also

including location, tag number, flow diagram number,

locational data, date of acquisition and cost information is as

follows:

Accelerated Depreciation, aka Cost Segregation Analysis

Accelerated depreciation allows companies to deduct the costs

of assets faster than their value actually declines. The thought

“faster than their value actually declines” is debatable.

Regardless of this possible debate, accelerated depreciation

does allow faster depreciation than straight line, and perhaps

over a shorter life. Further, depreciation for federal income tax

purposes usually will be faster than the “matching principle” of

usual accounting practices.

But rather than just an isolated machine or a computer, there

are cost components of new and/or previously owned facilities

that may be eligible for accelerated depreciation. This

important subset of the concept of accelerated depreciation by

appraisers and income tax practitioners is referred to as Cost

Segregation Analysis.

Under United States tax laws and accounting rules, cost

segregation is the process of identifying personal property

assets that are grouped with real property assets, and

separating out personal property assets for tax reporting

purposes. A cost segregation study identifies and reclassifies

personal property assets to shorten the depreciation time for

taxation purposes, which reduces current income tax

obligations. Personal property assets include a building’s non-

structural elements, exterior land improvements and allocated

indirect construction costs.

The primary goal of a cost segregation study is to identify all

construction-related costs that can be depreciated over a

shorter tax life (typically 3, 5, 7 and 15 years) rather than the

building (39 years for non-residential real property). Think cash

flow here based upon more depreciation for federal income

tax purposes. Yet the eligible assets (debatably) may be

classified differently for financial reporting purposes, thereby

realizing the financial benefits of both strategies. If so, the

fixed asset accounting system must be capable and structured

to accommodate these procedures.

Personal property assets found in a cost segregation study

generally include items that are affixed to the building but do

not relate to the overall operation and maintenance of the

building. Land / Site Improvements generally include items

located outside a building that are affixed to the land and are

not inherent to the overall operation and maintenance of a

building. Reducing tax lives results in accelerated depreciation

deductions, a reduced tax liability, and increased cash flow.

For an office building cost examples of non-structural

elements eligible for accelerated depreciation are “strippable /

reusable” wall covering, tacked down carpeting, millwork,

accent lighting, allocated portions of the electrical system, and

so forth. Relating to site improvements eligible property is site

improvements such as sidewalks and landscaping, etc. Again,

such eligible assets may be depreciated over 3, 5, 7 or 15

years, rather than over 39 years.

For a manufacturing or processing facility the components of

the facility that generally relate to the production processes

are eligible. Examples would be special exhaust systems and

drainage systems, equipment foundations, machinery

enclosures and platforms, allocated utilities, and so forth. A

very large enclosed equipment platform is not a 39 year lived

building.

Whether the facility is new or previously owned does not

matter. The “engineering” analyses of the costs eligible for

accelerated depreciation are similar. Further, it is not just the

direct costs that are eligible but also an allocation of the

indirect costs to each asset is includable in the calculation. This

latter consideration in the cost segregation analysis of new

facilities is often captured by service provider professionals.

For previously owned structures elements of indirect costs

sometimes may be overlooked, unless an experience appraiser

knowledgeable in cost segregation techniques handles the

allocation matter. Accountants usually cannot do this well.

Federal (IRS) / State (DOR) Income Tax Reporting

Financially it seems prudent to appropriately and legally pay

the least amount in taxes. Therefore, when completing an

valuation there is an innate orientation to optimize fixed asset

accounting booking strategies considering asset classification

and value element inclusion / treatment. Private entity clients

appreciate this orientation, particularly when they understand

that the appraisal / valuation fee may be greatly exceeded by

the present value of the cash flow enhancements through

accelerated depreciation / amortization. Some, however, due

to their particular tax / earnings orientation may not be able to

enjoy such financial benefits and unfortunately extend the

depreciation / amortization (the IRS / DOR is more pleased

with this). The public clients, who have an orientation towards

earnings enhancement, may be willing to pay an increased

income tax payment price by extending depreciation /

amortization (again, the IRS / DOR is pleased). There may be a

conflict of objectives between not only the private vs. the

public taxpayer, but also the profitable taxpayer vs. the less /

not profitable taxpayer.

So what to do? Discuss with the CEO / CFO or the other

appropriate party(s) the issues addressed, and others, within

this document. Communication and understanding is critical.

Be direct. Ask the simple question “are you tax or earnings

oriented”. Likely the private client will say “tax”. Then go

deeper by asking “can you stand as much accelerated

depreciation / amortization as may be appropriately

developed”. A caution, the maximum tax benefits may affect

loan covenants that are in place. Based upon the answers to

these questions discuss the available appraisal / valuation and

fixed asset accounting techniques that may be considered /

utilized.

The same questions should be asked of the public client,

whereas the private client may lean either way, more likely the

public client may lean towards earnings enhancement (but not

always). The public client may want to “balance” taxation

matters with the earnings objectives of the business operation.

This may well be a sensitive issue to discuss. Note that the

value information may not change but the classification of the

valuation data may be coded to fit the situation / objectives.

Fair Value Accounting